Benefits enrollment season is in full swing for 2025! It’s the perfect time to re-evaluate the options that can help you secure and strengthen your financial future. Whether this is your first enrollment period or you’ve been through it many times, reviewing your benefits is key. Your choices should be aligned with your personal and financial goals.

Here’s what you need to know to make this season count.

1. Health Insurance: Evaluate Your Needs, Don’t Just Renew

- Health Needs: Have your medical needs changed? If you anticipate more healthcare expenses, a plan with higher premiums but lower out-of-pocket costs might be wise.

- We often see this helpful for the year a child is born or a big surgery is planned

- Are you relatively healthy? Consider the benefits of a HDHP for maximizing your long term savings

- Network Changes: Confirm that your preferred doctors and healthcare providers are still in-network. It’s also worth comparing costs for any new providers you may need.

- HSA and FSA: If you’re on a high-deductible plan, consider opening a Health Savings Account (HSA) for tax-advantaged healthcare savings. If you decide a PPO or HMO fits your needs best, a Flexible Spending Account (FSA) can help with out-of-pocket expenses on a pre-tax basis.

- The maximum contribution allowed to an HSA in 2025 is $8,550 for families / $4,300 for individuals with a $1,000 catch up available to those over age 55. However, if your employer is contributing to your HSA as well, then the total maximum will include that amount

- The maximum contribution allowed to an FSA in 2025 is $3,300 per employee. These contributions must be used within the year or you lose them.

2. Retirement Plans: Make the Most of Matching Contributions

- Employer Match: If your employer offers matching contributions, aim to contribute enough to capture the full match. It’s essentially “free money” that grows tax-deferred.

- Investment Options: Revisit your portfolio choices to ensure they align with your current risk tolerance and retirement goals. Consider rebalancing if your allocations have drifted.

- Roth vs. Traditional Contributions: If your plan offers Roth contributions, think about your current tax bracket and anticipated future income. Roth contributions are taxed upfront but grow tax-free, which can be beneficial for future flexibility.

- The employee contribution maximum is $23,000 with a catch-up contribution for those over age 50 of $7,500

- After Tax 401(k) Contributions: Many tech companies now offer this benefit. This is a contribution to your 401(k) above and beyond your employee contribution.

- Your contribution to an after-tax 401(k) is limited to the overall 401(k) maximum contribution of $76,500. If your employer contributes to your 401(k) and you max out your employee contribution, you may still have ~$40,000+ you could put towards after-tax 401(k) contributions

- Learn more about whether this strategy – the Mega Backdoor Roth Strategy – is worth it on our blog or check out our YouTube video on Saving for Retirement for Tech Professionals

3. Disability and Life Insurance: Protect Your Income and Loved Ones

- Disability Insurance: This protects your income if you can’t work due to injury or illness. Short-term and long-term options are often available, so choose coverage that aligns with your savings and emergency fund.

- Most Company sponsored long-term disability plans cap out at $10,000/month. For many in tech, this does not cover their ongoing spending needs. Consider an additional individual policy if this is the case.

- Life Insurance: Consider your life insurance needs beyond what’s provided by your employer. While group life insurance is beneficial, it may not offer sufficient coverage for families with dependents or substantial financial obligations. Supplemental policies can bridge this gap.

- Company sponsored life insurance plans are also not as flexible as individual life insurance policies. You can take an individual policy with you from company to company and maintain the same premium payment for 10, 20 or 30 years.

4. Mental Health and Wellness Benefits: Make the Most of Available Resources

Companies also offer benefits aimed at supporting mental health and overall wellness. These programs can be valuable for both personal and financial well-being.

- Mental Health Support: Check for counseling or therapy services included in your plan. Some employers offer access to platforms that connect you with mental health professionals.

- Wellness Incentives: From gym memberships to mindfulness apps, wellness incentives can save you money on tools to help reduce stress, improve focus, and support a healthier lifestyle.

- Pet Insurance: There is even coverage for fido! If you have a dog, your company may offer a discount on a national pet insurance plan.

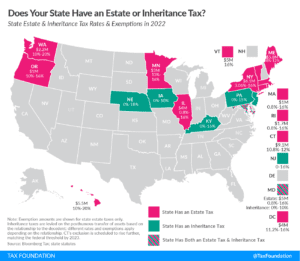

- Legal Plan Coverage: For some, this may mean using the plan for peace of mind and setting up an estate plan. For others, this benefit may be able to assist you in case of a dispute with a landlord or in an accident.

5. Educational Benefits: Invest in Future Growth

Many employers provide education assistance, whether through tuition reimbursement, certifications, or skill-building courses. This benefit can advance your career while relieving the financial burden. If upskilling or further education is on your radar, explore these opportunities to make the most of what’s available.

Look at what is required to obtain approval for the educational benefit. Some companies do not ask for this to be tied directly to a work outcome – you may be able to count this benefit towards flying lessons or art history classes!

6. Charitable Matching: Augmenting your Gifts

Are you charitably inclined? Review the charitable giving policy to make sure you are maximizing the benefits available to you. Many tech companies now match charitable gifts up to a certain amount ($100 to $10,000+)!

Already getting the full match and looking for more tax effective ways to give? Consider a Donor Advised Fund to use company stock, or other highly appreciated stock, to make an outsized impact.

Final Tips for Benefits Enrollment Season

- Review Benefits Annually: Life changes quickly, and so do your needs. Regularly reassessing your benefits ensures they’re always working in your favor.

- Ask Questions: Don’t hesitate to seek clarity from your HR department or benefits provider if anything is unclear. A little understanding now can lead to better decisions later.

- Think Beyond Open Enrollment: Your benefits are part of your long-term financial strategy. Consider how they fit with other financial goals, like retirement savings or estate planning, to ensure you’re covered comprehensively.

This season, take the time to make thoughtful, intentional choices that align with your life’s current chapter. With the right approach, your benefits can be a powerful foundation for both present security and future growth.

The above discussion is for informational purposes only. Recommendations are of a general nature, not based on knowledge of any individual’s specific needs or circumstances, and there is no intent to provide individual investment advisory, supervisory or management services.