As a financial planner, we talk in numbers and make it sound so simple. If you want X in the future, you have to give up $Y now in spending.

Are those choices easy to make though?

Financial plans are based on assumptions, and the outcome of the plan can seem distant and uneasy to grasp. So I compare it to building a home.

Where will you build? How many bedrooms? Two floors or one? With a pool? Before you can hire the architect to put together a design, there are a ton of questions to ask yourself.

In the financial plan process we start with defining and thinking about all the angles of your financial life and what you want.

By identifying your current, mid-term, and long-term goals, you set the blueprint for what the house looks like. You proverbially map out room sizes, doorways, and other details.

With this information, the builders can start their work. Determining how much cement is required for the foundation, how many beams are needed to create the walls based on the floor plan, etc.

Your goals will inform how much in savings and investments you need to make now to complete your goals later.

Once the builder knows how many pieces are required to complete the home, you receive a basic cost outline for the structure. Can you afford the basics? Maybe once you’ve seen the outline you decide you don’t really need a second guest room. How often will you have guests over anyways?

Next comes the interior designer. You chat about cabinet finishes, wood flooring, and whether brushed bronze door knobs or the standard silver will do.

Knowing the costs now help you prioritize what you value most in the home.

What do you value about building your own home? Was it about the location? Did all the other homes have two bedrooms but your family needed a third bedroom?

Then, if you get a bonus or raise later, you can decide where to add flexibility. Maybe you will start with carpet and standard silver door knobs, and then upgrade to wood floors and brushed bronze door knobs. If it happens, great – but if not, it doesn’t affect your most important value of being in that location.

Every decision you make is a trade-off between current and future expenses. Future expenses are the savings and investments you make now to be ready for these expenses later.

You are always making these decisions. Even not making a decision is a decision in the end.

Financial plans start with knowing your values, identifying your goals, and establishing priorities. What kind of life do you want to build?

Schedule a consultation to see how we can help.

Did you enjoy this post? Sign Up for my newsletter so you won’t miss another article.

The above discussion is for informational purposes only. Recommendations are of a general nature, not based on knowledge of any individual’s specific needs or circumstances, and there is no intent to provide individual investment advisory, supervisory or management services.

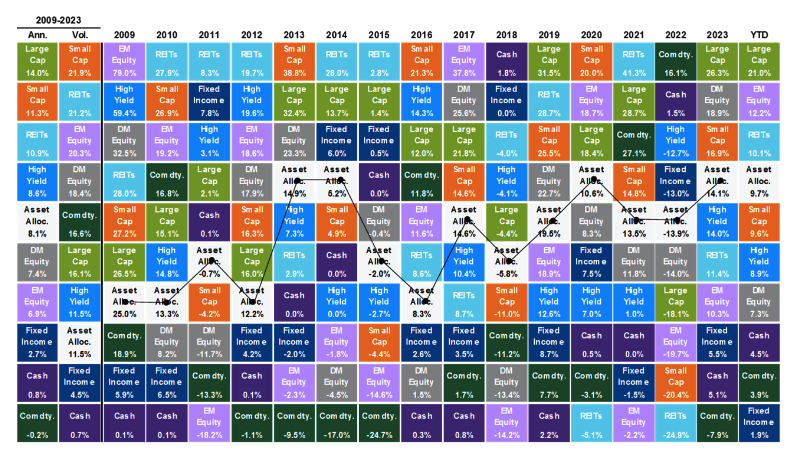

JP Morgan returns from JP Morgan Quarterly Market Review, Q3 2024

JP Morgan returns from JP Morgan Quarterly Market Review, Q3 2024